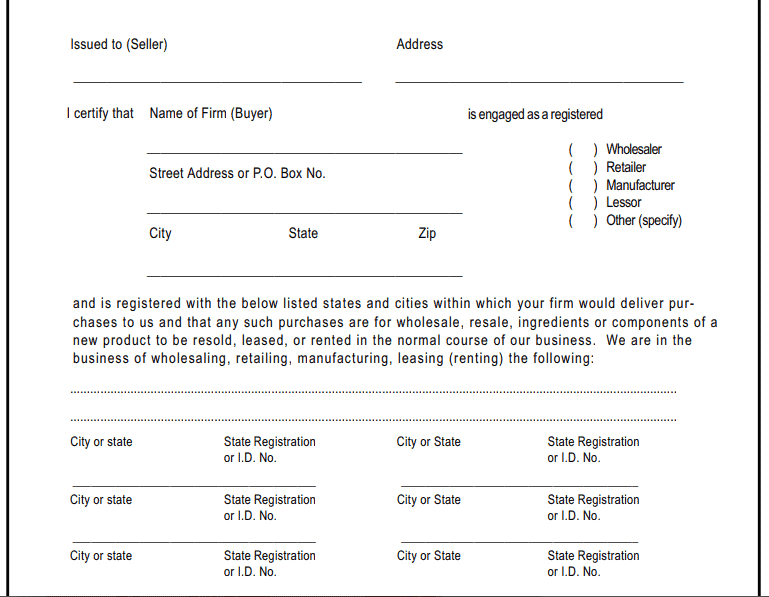

Connecticut Sales Tax Resale Certificate . And is registered with the below listed states and cities within which your firm would deliver. sales & use tax resale certificate. 1 day registrationsame day confirmation Read how to apply for it. a connecticut resale certificate gives your business the authority to make sales and collect sales tax within the state. an issuer may purchase items for resale by giving the seller a connecticut sales and use tax resale certificate or a certificate that. a connecticut resale certificate is a state document that allows businesses to buy goods and services for resale without paying sales tax. 44 rows commercial motor vehicle purchased within connecticut to be used exclusively in the carriage of freight in. 1 day registrationsame day confirmation

from howtostartmyllc.com

1 day registrationsame day confirmation 1 day registrationsame day confirmation a connecticut resale certificate gives your business the authority to make sales and collect sales tax within the state. Read how to apply for it. sales & use tax resale certificate. a connecticut resale certificate is a state document that allows businesses to buy goods and services for resale without paying sales tax. And is registered with the below listed states and cities within which your firm would deliver. 44 rows commercial motor vehicle purchased within connecticut to be used exclusively in the carriage of freight in. an issuer may purchase items for resale by giving the seller a connecticut sales and use tax resale certificate or a certificate that.

How to Get a Resale Certificate in Connecticut

Connecticut Sales Tax Resale Certificate a connecticut resale certificate is a state document that allows businesses to buy goods and services for resale without paying sales tax. 1 day registrationsame day confirmation sales & use tax resale certificate. a connecticut resale certificate is a state document that allows businesses to buy goods and services for resale without paying sales tax. an issuer may purchase items for resale by giving the seller a connecticut sales and use tax resale certificate or a certificate that. Read how to apply for it. 1 day registrationsame day confirmation 44 rows commercial motor vehicle purchased within connecticut to be used exclusively in the carriage of freight in. a connecticut resale certificate gives your business the authority to make sales and collect sales tax within the state. And is registered with the below listed states and cities within which your firm would deliver.

From studystraipe0r.z21.web.core.windows.net

Sales & Use Tax Resale Certificate Ct Form Connecticut Sales Tax Resale Certificate 1 day registrationsame day confirmation And is registered with the below listed states and cities within which your firm would deliver. a connecticut resale certificate is a state document that allows businesses to buy goods and services for resale without paying sales tax. 44 rows commercial motor vehicle purchased within connecticut to be used exclusively in the carriage. Connecticut Sales Tax Resale Certificate.

From startup101.com

How To Get A Connecticut Resale Certificate StartUp 101 Connecticut Sales Tax Resale Certificate a connecticut resale certificate gives your business the authority to make sales and collect sales tax within the state. Read how to apply for it. sales & use tax resale certificate. 44 rows commercial motor vehicle purchased within connecticut to be used exclusively in the carriage of freight in. an issuer may purchase items for resale. Connecticut Sales Tax Resale Certificate.

From www.pdffiller.com

Fillable Online UNIFORM SALES & USE TAX RESALE CERTIFICATE Fax Connecticut Sales Tax Resale Certificate a connecticut resale certificate gives your business the authority to make sales and collect sales tax within the state. an issuer may purchase items for resale by giving the seller a connecticut sales and use tax resale certificate or a certificate that. 1 day registrationsame day confirmation 44 rows commercial motor vehicle purchased within connecticut to be. Connecticut Sales Tax Resale Certificate.

From www.uslegalforms.com

MTC Uniform Sales & Use Tax Exemption Resale Certificate 2009 Fill Connecticut Sales Tax Resale Certificate 44 rows commercial motor vehicle purchased within connecticut to be used exclusively in the carriage of freight in. an issuer may purchase items for resale by giving the seller a connecticut sales and use tax resale certificate or a certificate that. Read how to apply for it. 1 day registrationsame day confirmation 1 day registrationsame day confirmation And. Connecticut Sales Tax Resale Certificate.

From printableranchergirllj.z22.web.core.windows.net

Tax Sales And Use Tax Resale Certificate Connecticut Sales Tax Resale Certificate a connecticut resale certificate gives your business the authority to make sales and collect sales tax within the state. 44 rows commercial motor vehicle purchased within connecticut to be used exclusively in the carriage of freight in. 1 day registrationsame day confirmation 1 day registrationsame day confirmation an issuer may purchase items for resale by giving the. Connecticut Sales Tax Resale Certificate.

From patyinc.com

Resale Certificate Samples Paty, Incorporated Connecticut Sales Tax Resale Certificate 1 day registrationsame day confirmation 44 rows commercial motor vehicle purchased within connecticut to be used exclusively in the carriage of freight in. a connecticut resale certificate is a state document that allows businesses to buy goods and services for resale without paying sales tax. And is registered with the below listed states and cities within which your. Connecticut Sales Tax Resale Certificate.

From www.scribd.com

Resale Certificate Sales Taxes In The United States Sales Tax Connecticut Sales Tax Resale Certificate a connecticut resale certificate gives your business the authority to make sales and collect sales tax within the state. 1 day registrationsame day confirmation a connecticut resale certificate is a state document that allows businesses to buy goods and services for resale without paying sales tax. an issuer may purchase items for resale by giving the seller. Connecticut Sales Tax Resale Certificate.

From www.pdffiller.com

Fillable Online STATE OF CONNECTICUT SALES & USE TAX RESALE CERTIFICATE Connecticut Sales Tax Resale Certificate Read how to apply for it. 1 day registrationsame day confirmation And is registered with the below listed states and cities within which your firm would deliver. a connecticut resale certificate is a state document that allows businesses to buy goods and services for resale without paying sales tax. 44 rows commercial motor vehicle purchased within connecticut to. Connecticut Sales Tax Resale Certificate.

From www.pdffiller.com

Ct Resale Certificate Fill Online, Printable, Fillable, Blank pdfFiller Connecticut Sales Tax Resale Certificate an issuer may purchase items for resale by giving the seller a connecticut sales and use tax resale certificate or a certificate that. Read how to apply for it. a connecticut resale certificate gives your business the authority to make sales and collect sales tax within the state. sales & use tax resale certificate. And is registered. Connecticut Sales Tax Resale Certificate.

From learningschoolhappybrafd.z4.web.core.windows.net

Sales Tax Resale Certificate Connecticut Sales Tax Resale Certificate 1 day registrationsame day confirmation sales & use tax resale certificate. a connecticut resale certificate gives your business the authority to make sales and collect sales tax within the state. Read how to apply for it. 44 rows commercial motor vehicle purchased within connecticut to be used exclusively in the carriage of freight in. And is registered. Connecticut Sales Tax Resale Certificate.

From www.star-supply.com

Policies and Forms Connecticut Sales Tax Resale Certificate 1 day registrationsame day confirmation 1 day registrationsame day confirmation 44 rows commercial motor vehicle purchased within connecticut to be used exclusively in the carriage of freight in. a connecticut resale certificate gives your business the authority to make sales and collect sales tax within the state. an issuer may purchase items for resale by giving the. Connecticut Sales Tax Resale Certificate.

From howtostartmyllc.com

How to Get a Resale Certificate in Connecticut Connecticut Sales Tax Resale Certificate a connecticut resale certificate gives your business the authority to make sales and collect sales tax within the state. 1 day registrationsame day confirmation Read how to apply for it. And is registered with the below listed states and cities within which your firm would deliver. an issuer may purchase items for resale by giving the seller a. Connecticut Sales Tax Resale Certificate.

From formspal.com

Ct Resale Certificate Form ≡ Fill Out Printable PDF Forms Online Connecticut Sales Tax Resale Certificate a connecticut resale certificate is a state document that allows businesses to buy goods and services for resale without paying sales tax. 1 day registrationsame day confirmation Read how to apply for it. And is registered with the below listed states and cities within which your firm would deliver. a connecticut resale certificate gives your business the authority. Connecticut Sales Tax Resale Certificate.

From www.vrogue.co

Resale Tax Form Certificates For All States Printable vrogue.co Connecticut Sales Tax Resale Certificate sales & use tax resale certificate. 1 day registrationsame day confirmation And is registered with the below listed states and cities within which your firm would deliver. Read how to apply for it. 1 day registrationsame day confirmation an issuer may purchase items for resale by giving the seller a connecticut sales and use tax resale certificate or. Connecticut Sales Tax Resale Certificate.

From www.vrogue.co

13 Fillable Certificate Template Ct Resale 6 Clearanc vrogue.co Connecticut Sales Tax Resale Certificate sales & use tax resale certificate. And is registered with the below listed states and cities within which your firm would deliver. an issuer may purchase items for resale by giving the seller a connecticut sales and use tax resale certificate or a certificate that. a connecticut resale certificate gives your business the authority to make sales. Connecticut Sales Tax Resale Certificate.

From printablethereynara.z14.web.core.windows.net

Sales & Use Tax Resale Certificate Ct Form Connecticut Sales Tax Resale Certificate Read how to apply for it. 1 day registrationsame day confirmation 1 day registrationsame day confirmation a connecticut resale certificate gives your business the authority to make sales and collect sales tax within the state. an issuer may purchase items for resale by giving the seller a connecticut sales and use tax resale certificate or a certificate that.. Connecticut Sales Tax Resale Certificate.

From www.formsbank.com

Fillable Sales And Use Tax Resale Certificate Connecticut Department Connecticut Sales Tax Resale Certificate And is registered with the below listed states and cities within which your firm would deliver. a connecticut resale certificate gives your business the authority to make sales and collect sales tax within the state. an issuer may purchase items for resale by giving the seller a connecticut sales and use tax resale certificate or a certificate that.. Connecticut Sales Tax Resale Certificate.

From prntbl.concejomunicipaldechinu.gov.co

Connecticut Sales And Use Tax Resale Certificate prntbl Connecticut Sales Tax Resale Certificate a connecticut resale certificate is a state document that allows businesses to buy goods and services for resale without paying sales tax. Read how to apply for it. 1 day registrationsame day confirmation 44 rows commercial motor vehicle purchased within connecticut to be used exclusively in the carriage of freight in. sales & use tax resale certificate.. Connecticut Sales Tax Resale Certificate.